Why OpenAI is trying to untangle its 'bespoke' corporate structure

On the Friday after Christmas, OpenAI revealed a weblog put up titled “Why OpenAI’s construction should evolve to advance our mission.” In it, the corporate detailed a plan to reorganize its for-profit arm right into a public profit company (PBC). Within the weeks since that announcement, I’ve spoken to a number of the nation’s main company legislation consultants to achieve a greater understanding of OpenAI’s plan, and, extra importantly, what it would imply for its mission to construct protected synthetic basic intelligence (AGI).

What’s a public profit company?

“Public profit firms are a comparatively current addition to the universe of enterprise entity sorts,” says , professor of company legislation on the College of Texas College of Regulation. Relying on who you ask, you might get a special historical past of PBCs, however within the dominant narrative, they got here out of a certification program created by a nonprofit known as . Firms that full a self-assessment and pay an annual payment to B Lab can carry the B Lab emblem on their merchandise and web sites and name themselves B-Corps. Critically, B Corp standing is not a designation with the burden of legislation, and even an industry-wide group, behind it — it is a stamp of approval from this particular nonprofit.

Because of this, B Lab ultimately felt the certification program “was not sufficient,” says Professor , govt director of the Lowell Milken Institute for Enterprise Regulation and Coverage at UCLA. “They wished one thing extra everlasting and extra rooted within the legislation.” So the group started working with authorized consultants to create a mannequin statute for what would turn into the profit company. B Lab lobbied state legislatures to go legal guidelines recognizing profit firms as authorized entities, and in 2010, Maryland grew to become the primary state to take action. , Delaware enacted its personal model of the legislation. To make issues considerably complicated, the state went with a special identify: the general public profit company.

Delaware is arguably crucial state for company legislation within the US, due to the Delaware Chancery Courtroom and its physique of business-friendly case legislation. , 68.2 % of all Fortune 500 corporations, together with many tech giants, are included within the state regardless of largely working elsewhere. Delaware can be the state the place OpenAI plans to reincorporate its for-profit as a PBC.

The essential thought behind public profit firms is that they are enterprise entities that impose a constraint on their board to stability revenue maximization, a public profit that is said within the constitution of the corporate, and the considerations of individuals impacted by its conduct.

“It is a bit of a paradigm shift,” says Professor Dammann, however do not confuse a PBC with a nonprofit. “The important thing attribute of a nonprofit is what we name a non-distribution constraint, that means if a nonprofit makes a revenue, they cannot distribute it to their shareholders,” Professor Dammann says. “Should you type a public profit company, there is no such non-distribution constraint. At its coronary heart, a PBC continues to be a for-profit company.”

Why is OpenAI pursuing a PBC construction?

Firstly, a PBC construction — whether or not it is personal or promoting share on the open market — would get OpenAI out from beneath that non-distribution constraint. However there are doubtless another issues at play.

OpenAI hasn’t publicly mentioned this, however it seems a few of its workers consider a PBC construction may shield the corporate from a hostile takeover if it have been to go public. In a current , a supply inside the firm mentioned a PBC construction would give OpenAI a “protected harbor” if a rival agency have been to attempt to purchase the corporate. It “offers you much more flexibility to say ‘thanks for calling and have a pleasant day’,” the particular person mentioned.

The precise risk OpenAI doubtless desires protected harbor from is what’s generally known as the Revlon doctrine, which is called after a 1986 Delaware Supreme Courtroom case involving the cosmetics firm Revlon Inc. and now defunct grocery store chain Pantry Satisfaction, then led by CEO Ronald Perelman. “The Revlon doctrine holds that when you’re a publicly traded company (included in Delaware) and any individual levels a takeover try, then beneath sure circumstances, you must promote to the best bidder,” says Professor Dammann.

The underlying rationale behind Revlon is {that a} for-profit firm’s sole operate is to generate earnings, so the board is pressured to make no matter alternative will return probably the most cash to shareholders.

“We do not know for certain, however we’re pretty assured that the Revlon doctrine does not apply to public profit firms,” says Professor Dammann. Theoretically, PBC boards might have the flexibleness to reject a takeover bid in the event that they consider a purchaser will not adhere to the social values the corporate was based on. Nevertheless, as a result of “none of this has been litigated,” in keeping with Professor Dorff, it stays a purely hypothetical protection.

Furthermore, it is unclear if reorganizing as a PBC would provide OpenAI extra safety in opposition to a hostile takeover try than what it already has as a nonprofit. “I do not assume this has been examined with this explicit form of construction, however my sense is that the nonprofit wouldn’t be obligated to promote even in a Revlon second,” says Professor Dorff.

“We have to elevate extra capital”

Publicly, OpenAI has mentioned it must safe extra funding, and that its present construction is holding it again. “We as soon as once more want to lift extra capital than we would imagined,” OpenAI wrote in December, two months after securing in new enterprise funding. “Traders need to again us however, at this scale of capital, want typical fairness and fewer structural bespokeness.”

Unpacking what the corporate doubtless means by “structural bespokeness” requires a brief historical past lesson. In 2019, when OpenAI its for-profit arm, it organized the corporate utilizing a singular “capped-profit” construction. The corporate mentioned it could restrict investor returns to 100x, with extra returns going to the nonprofit. “We count on this a number of to be decrease for future rounds as we make additional progress,” OpenAI added.

It is honest to be essential of the corporate’s claims. “You’d need to ask the traders, however I’ve to say that 100x is an distinctive price or return, so the concept you can’t get funding due to a 100x cap appears wealthy to me,” says Professor Dorff. In actual fact, there are solutions OpenAI was already making itself extra enticing to traders earlier than asserting its reorganization plan in December. In 2023, reported that the corporate modified its cap to extend (and never lower as OpenAI had initially mentioned it could) by 20 % per yr beginning in 2025. At the moment, OpenAI doesn’t count on to be worthwhile , and racked up about final yr.

“We need to improve our means to lift capital whereas nonetheless serving our mission, and no pre-existing construction we all know of strikes the suitable stability,” OpenAI mentioned in 2019. At that time, Delaware’s PBC laws had been legislation for practically six years. Nevertheless, the corporate is now arguing {that a} PBC construction would “allow us to lift the mandatory capital with typical phrases like others on this area.”

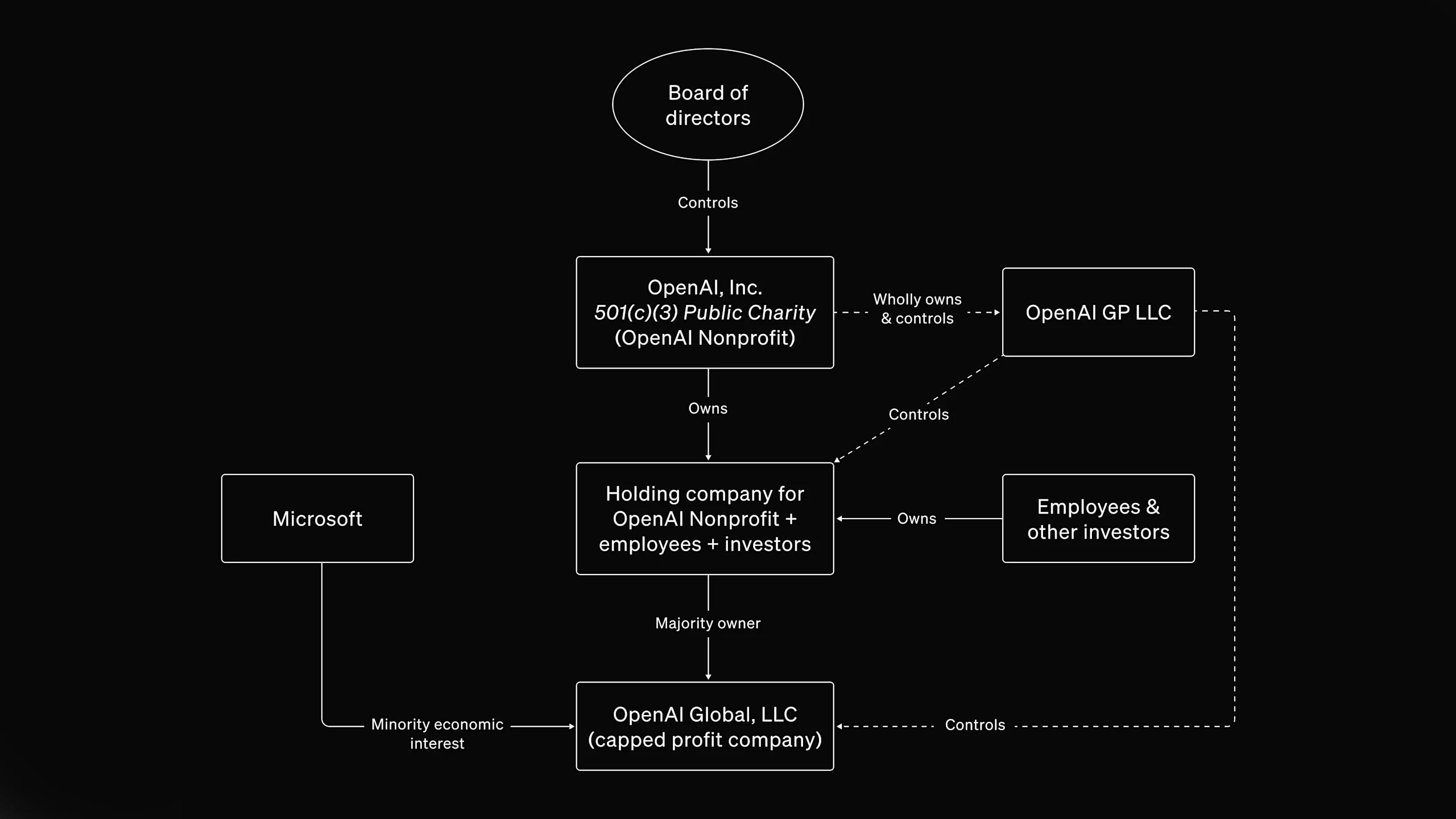

In OpenAI’s protection, calling its present construction convoluted could be an understatement. As you’ll be able to see from the corporate’s personal org chart, there are two different entities beneath the OpenAI umbrella, together with a holding firm that is an middleman between the nonprofit and for-profit. Engadget was capable of finding a minimum of 11 completely different Delaware corporations registered to OpenAI. George R.R. Martin, Jodi Picoult and different members of the Writer’s Guild in all probability described it finest of their copyright lawsuit in opposition to the corporate, calling OpenAI “a tangled thicket of interlocking entities that typically hold from the general public what the exact relationships amongst them are and what operate every entity serves inside the bigger company construction.”

OpenAI didn’t reply to a number of requests for remark from Engadget.

“A stronger nonprofit supported by the for-profit’s success”

OpenAI’s nonprofit arm does primarily two issues: controls the for-profit facet’s enterprise, and exists as a “car” to develop “protected and broadly helpful AGI” (synthetic basic intelligence).

In keeping with the corporate, its present construction doesn’t permit its nonprofit arm to “simply do greater than management the for-profit.” If it have been freed of that duty — by say, handing it off to traders — OpenAI suggests its nonprofit may focus its sources on charitable initiatives, all whereas changing into “one of many best-resourced nonprofits in historical past.”

To treatment the state of affairs, OpenAI’s board says the nonprofit ought to hand over absolute management over the for-profit and take no matter diploma of management comes with the quantity of inventory it is granted via the reorganization course of. “The nonprofit’s vital curiosity within the present for-profit would take the type of shares within the PBC at a good valuation decided by impartial monetary advisors,” OpenAI says of this a part of its plan.

Professor Dorff argues who controls OpenAI is essential to the corporate sustaining its mission. The transfer to reorganize the for-profit as a PBC isn’t controversial. “Firms do it on a regular basis; there’s a simple and clear course of to do this,” he tells me. “What’s controversial is what they’re attempting to do to vary the character of the nonprofit’s possession curiosity within the for-profit.”

On the threat of oversimplifying issues, OpenAI’s board of administrators desires to divest the corporate’s nonprofit of two of its most essential belongings: management of the for-profit and its rights to the earnings from AGI. “You possibly can’t simply try this,” says Professor Dorff. “The belongings of the nonprofit should stay devoted to the aim of the nonprofit.” There are guidelines that permit nonprofits to change their function if their unique one is made defunct, however these will not apply to OpenAI since we’re not dwelling in a world with protected (or any) AGI.

Consider it this manner, what’s the worth of synthetic basic intelligence? It isn’t a conventional asset like actual property or the EVs offered by Tesla. AGI, as , does not but and should by no means exist. “One may think about it is value all of the labor of the economic system as a result of it may ultimately exchange human labor,” says Professor Dorff. Regardless of the eventual worth of the expertise, Professor Dorff says he is not sure “any quantity would allow the nonprofit to do what it is alleged to do with out management.”

Regardless of how OpenAI spins it, any model of this plan would end in a large lack of management for the present nonprofit entity and its board.

Yet another factor

One thing the consultants I spoke to agreed on was that the legal guidelines governing PBCs aren’t very efficient at making certain corporations persist with their social function. “The authorized constraints aren’t very strict,” Professor Dammann says, including, “the issue with a really broad public profit is that it isn’t so constraining anymore. Should you’re devoted to a really broad model of the general public good, then you’ll be able to at all times defend each resolution, proper?”

“The twin aim of revenue and public function does not actually let you know how an organization goes to handle these goals,” says , professor of Enterprise Regulation on the College of Pennsylvania Regulation College. “To the extent that public function sacrifices earnings, and it does not need to, however to the extent that it does, how a lot of a sacrifice is contemplated?”

“What issues loads in PBC governance is what the personal preparations are,” Professor Dorff provides. “That’s, what do the paperwork say?” An organization’s certificates of incorporation, shareholder agreements and bylaws can present “very sturdy” (or only a few) mechanisms to make sure it sticks to its social function. As Professor Dorff factors out, OpenAI’s weblog put up mentioned “nothing about these.”

Distinction that with when OpenAI its “capped revenue” plan. It gave us a glimpse of a few of its paperwork, sharing a clause it mentioned was at first of all of its worker and investor agreements. That snippet made it clear OpenAI was beneath no obligation to generate a revenue. Proper now, there’s loads we do not learn about its restructuring plan. If the corporate continues to be critical about its mission of “making certain synthetic basic intelligence advantages all of humanity” it owes the general public extra transparency.

What occurs subsequent?

Elon Musk’s current bid to purchase the nonprofit’s belongings complicates OpenAI’s plan. On this state of affairs, the nonprofit is not obligated to promote its belongings to Musk beneath Revlon or anything — the corporate merely isn’t on the market. Nevertheless, as a part of OpenAI’s reorganization plan, the for-profit might want to compensate the nonprofit for its independence. Musk’s bid doubtless an try to inflate the value of this transaction to at least one increased than what Sam Altman and the remainder of OpenAI’s board of administrators had in thoughts. To say Musk and Altman have had for the reason that former left OpenAI could be an understatement on a grand scale, and having an enemy who not solely has probably the most cash of any human on the planet, but additionally broad and largely unchecked management of the US’ , might frustrate plans.

OpenAI additionally faces a ticking clock. In keeping with paperwork seen by , the corporate has, beneath the phrases of its , lower than two years to free its for-profit from management of the nonprofit. If it fails to take action, the $6.6 billion it raised in new funding will turn into debt.

This text initially appeared on Engadget at https://www.engadget.com/ai/why-openai-is-trying-to-untangle-its-bespoke-corporate-structure-160028589.html?src=rss